UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Preliminary Proxy Statement |

| Confidential, |

| x | Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to § 240.14a-12 |

| x | No fee required. |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| Fee paid previously with preliminary materials: |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

![[GRAPHIC MISSING]](https://capedge.com/proxy/DEF 14A/0001144204-09-019577/logo_stoneridge.jpg)

| Election of seven directors, each for a term of one year; |

| Ratification of the appointment of Ernst & Young |

| 3. | An advisory vote on executive compensation; |

| 4. | An advisory vote on the |

| Proposal to approve the |

| Any |

By order of the Board of Directors,

ROBERT M. LOESCH,Secretary

envelope or to vote by telephone or Internet.

| By order of the Board of Directors, | |

| |

| ROBERT M. LOESCH, | |

| Secretary | |

12, 2011

9, 2011:

www.edocumentview.com/sri.

IMPORTANT.

OR PROVIDE YOUR VOTE BY TELEPHONE OR INTERNET.

12, 2011.

www.edocumentview.com/sri.

If you hold your Company common shares in “street name”, in order to change or revoke your voting instructions you must follow the specific voting directions provided to you by your bank, broker or other holder of record.

1

| · | You may vote by mail: complete and sign your proxy card and mail it in the enclosed, prepaid and addressed envelope. |

| · | You may vote by telephone: call toll-free 1-800-652-VOTE (8683) on a touch-tone phone and follow the instructions. You will need your proxy card available if you vote by telephone. |

| · | You may vote by Internet: access www.envisionreports.com/sri and follow the instructions. You will need your proxy card available if you vote by Internet. |

| · | You may vote in person at the meeting, however, you are encouraged to vote by proxy card, telephone or Internet even if you plan to attend the meeting. |

| · | You must vote your common shares through the procedures established by your bank, broker, or other holder of record. Your bank, broker, or other holder of record has enclosed or otherwise provided a voting instruction card for you to use in directing the bank, broker, or other holder of record how to vote your common shares. |

| · | You may vote at the meeting however, to do so, you will first need to ask your bank, broker or other holder of record to furnish you with a legal proxy. You will need to bring the legal proxy with you to the meeting and hand it in with a signed ballot that you can request at the meeting. You will not be able to vote your common shares at the meeting without a legal proxy and signed ballot. |

| Name of Beneficial Owner | Number of Shares Beneficially Owned(1) | Percent of Class | ||||||

| C. M. Draime(2) | 5,650,000 | 22.9 | % | |||||

| Jeffrey P. Draime(3) | 3,025,930 | 12.3 | ||||||

| Dimensional Fund Advisors LP(4) | 1,495,247 | 6.1 | ||||||

| KPR Capital Management, LLC(5) | 1,439,531 | 5.8 | ||||||

| John C. Corey(6) | 575,161 | 2.3 | ||||||

| Earl L. Linehan(7) | 309,179 | 1.3 | ||||||

| Sheldon J. Epstein(8) | 62,735 | * | ||||||

| William M. Lasky(9) | 43,100 | * | ||||||

| Douglas C. Jacobs(10) | 22,600 | * | ||||||

| Kim Korth(11) | 10,500 | * | ||||||

| Ira C. Kaplan | — | * | ||||||

| Paul J. Schlather | — | * | ||||||

| George E. Strickler(12) | 163,197 | * | ||||||

| Thomas A. Beaver(13) | 127,153 | * | ||||||

| Mark J. Tervalon(14) | 102,935 | * | ||||||

| Martin Malmvik(15) | 17,825 | * | ||||||

| All Executive Officers and Directors as a Group (11 persons) | 4,460,315 | 18.1 | % | |||||

| Number of | ||||||||

| Shares | Percent | |||||||

| Beneficially | of | |||||||

| Name of Beneficial Owner | Owned (1) | Class | ||||||

Wellington Management Company LLP (2) | 2,266,670 | 8.9 | % | |||||

BlackRock, Inc. (3) | 1,444,926 | 5.6 | ||||||

Dimensional Fund Advisors LP (4) | 1,321,647 | 5.2 | ||||||

FMR LLC (5) | 1,305,637 | 5.1 | ||||||

John C. Corey (6) | 833,188 | 3.3 | ||||||

Jeffrey P. Draime (7) | 421,694 | 1.6 | ||||||

George E. Strickler (8) | 259,551 | 1.0 | ||||||

Thomas A. Beaver (9) | 191,134 | * | ||||||

Mark J. Tervalon (10) | 170,399 | * | ||||||

William M. Lasky (11) | 81,180 | * | ||||||

Michael D. Sloan (12) | 72,798 | * | ||||||

Paul J. Schlather (13) | 51,317 | * | ||||||

Douglas C. Jacobs (14) | 43,700 | * | ||||||

Kim Korth (15) | 21,540 | * | ||||||

Ira C. Kaplan (16) | 15,892 | * | ||||||

| All Executive Officers and Directors as a Group (11 persons) | 2,162,393 | 8.5 | % | |||||

| * | Less than 1%. |

| (1) | Unless otherwise indicated, the beneficial owner has sole voting and investment power over such common shares. |

| (2) |

| According to a Schedule 13G filed with the Securities and Exchange Commission (“SEC”) by Wellington Management Company, LLP, in its capacity as investment advisor, may be deemed to beneficially own the common shares which are held of record by clients of Wellington Management Company, LLP. The address of Wellington Management Company LLP is 280 Congress Street, Boston, Massachusetts 02210. |

| (3) | According to a Schedule 13G filed with the SEC by BlackRock, Inc. The address of BlackRock, Inc. is 40 East 52nd Street, New York, New York 10022. |

| (4) | According to a Schedule 13G filed with the SEC by Dimensional Fund Advisors LP, all common shares are owned by advisory clients of Dimensional Fund Advisors LP. Dimensional Fund Advisors LP has disclaimed beneficial ownership of all such securities. The address of Dimensional Fund Advisors LP is Palisades West, Building One, 6300 Bee Cave Road, Austin, Texas 78746. |

| (5) | According to a Schedule 13G filed with the SEC by |

| (6) | Represents 10,000 common shares that Mr. Corey has the right to acquire upon the exercise of share options, |

2

| (7) | Represents |

| (8) | Represents 177,760 restricted common shares, which are subject to forfeiture, and 81,791 common shares owned by Mr. Strickler directly. |

| (9) | Represents 20,000 common shares that Mr. |

| Represents |

| Represents 10,000 common shares that Mr. Lasky has the right to acquire upon the exercise of share options, |

| Represents |

| Represents |

| (14) | Represents 3,800 restricted common shares, which are subject to forfeiture, 32,600 common shares held in trust for which Mr. Jacobs has shared voting and investment power, and 7,300 common shares owned directly by Mr. Jacobs. |

| (15) | Represents 3,800 restricted common shares, which are subject to forfeiture, and |

| Represents |

3

| John C. Corey | Mr. Corey, 63, was elected to the Board in 2004. Mr. Corey is the President and Chief Executive Officer of the Company and has served in this role since January 2006. Mr. Corey served as the President and Chief Executive Officer of Safety Components International, a supplier of air bags and components, from October 2000 until January 2006 and Chief Operating Officer from 1999 to 2000. | |||||

| In addition to his professional experience described above, the Company believes that Mr. Corey should serve as a director because he has successfully guided companies through restructuring initiatives and executed performance and strategies development initiatives throughout his career. Through his leadership and industry experience, from both an operational and financial perspective, he provides valuable insight to the Board and strengthens the Board’s collective qualifications, skills and experience. | ||||||

| Jeffrey P. Draime | ||||||

| Douglas C. Jacobs | Mr. Jacobs, 71, was elected to the Board in 2004. He is the Executive Vice | |

| Mr. Jacobs qualifies as an audit committee financial expert due to his extensive background in accounting and finance built through his career in public accounting. In addition to his professional and accounting experience described above, the Company believes that Mr. Jacobs should serve as a director because he provides valuable business experience and judgment to the Board which strengthens the Board’s collective qualifications, skills and experience. | ||

| Ira C. Kaplan | Mr. Kaplan, 57, was elected to the Board in 2009. He has served as the Managing Partner of Benesch, Friedlander, Coplan & Aronoff, LLP, a national law firm, since January 2008, is a member of the firm’s Executive Committee, and has been a partner with the firm since 1987. Mr. Kaplan focuses his practice on mergers and acquisitions as well as public and private debt and equity financings. | |

| Kim Korth | Ms. Korth, 56, was elected to the Board in 2006. Ms. Korth is the founder, owner and President of IRN, Inc., an international automotive consulting firm. She has led the consulting firm since 1983 and is viewed as an expert on automotive supplier strategy and issues. In February 2011, Ms. Korth was appointed President, Chief Executive Officer and as a Director of Superior Industries, Inc. and its wholly-owned subsidiary, Supreme Indiana Operations, a manufacturer of truck and van bodies. | |

| Ms. Korth has several decades of experience in corporate governance issues, organizational design, and development of strategies for growth and improved financial performance for automotive suppliers. In addition to the knowledge and experience described above, the Company believes that Ms. Korth should serve as a director because she provides insight to industry trends and expectations to the Board which strengthens the Board’s collective qualifications, skills and experience. |

| William M. Lasky | ||||||

| In addition to his professional experience described above, the Company believes that Mr. Lasky should serve as a director because he provides in-depth industry knowledge, business acumen and leadership to the Board which strengthens the Board’s collective qualifications, skills and experience. | ||||||

| Paul J. Schlather |

Each of the nominees for election as a director has engaged in the principal occupation or activity indicated for at least five years, except for the following:

Mr. Corey was the President and Chief Executive Officer of Safety Components International (a supplier of air bags and components) from October 2000 until January 2006. On January 16, 2006, Mr. Corey was appointed President and Chief Executive Officer of the Company.

Mr. Jacobs, a former partner of the accounting firm Arthur Andersen LLP, was Vice President — Finance, Chief Financial Officer and Treasurer of the Cleveland Browns from 1999 to 2001, when he became the organization’s Executive Vice President — Finance, Chief Financial Officer and Treasurer until December 2005. In January 2006, Mr. Jacobs became Executive Vice President — Finance and Chief Financial Officer of Brooklyn NY Holdings LLC, a privately held investment advisory company established to manage the assets of a family and family trust, which includes the Cleveland Browns.

4

Mr. Kaplan has been a partner at Benesch, Friedlander, Coplan & Aronoff LLP since 1987 and has served in several management capacities prior to assuming the position of Managing Partner in January 2008.

Mr. Lasky served as Chairman, Chief Executive Officer and President of JLG Industries, Inc., a diversified construction and industrial equipment manufacturer, from January 2001 until December 2006. Mr. Lasky became Interim President and Chief Executive Officer of Accuride Corporation in September 2008 and Chairman of the Board of Accuride Corporation in January 2009.

Mr. Schlather was a partner at PricewaterhouseCoopers LLP serving as co-head to the Private Client Service group from August 2002 until his retirement in June 2008.

Directorships

Mr. Corey is a director and chairman of the board of directors of Haynes International, Inc. (a producer of metal alloys). Mr. Jacobs is a director of Standard Pacific Corporation (a national residential home builder in southern California), serving as chairman of its audit committee and as a member of its nominating and corporate governance committee. Mr. Lasky is a director and chairman of the board of directors of Accuride Corporation (a manufacturer and supplier of commercial vehicle components).

CORPORATE GOVERNANCE

Corporate Governance Documents and Committee Charters

The Company’s Corporate Governance Guidelines, Code of Business Conduct and Ethics, Code of Ethics for Senior Financial Officers and the charters of the Board of Directors’ Compensation, Audit, and Nominating and Corporate Governance committees are posted on our web site atwww.stoneridge.com. Written copies of these documents will be available to any shareholder upon request. Requests should be directed to Investor Relations at the Company’s address listed on the Notice of Annual Meeting of Shareholders.

Corporate Ethics Hotline

The Company established a corporate ethics hotline as part of the Company’s Whistleblower Policy and Procedures to allow persons to lodge complaints about accounting, auditing and internal control matters, and to allow an employee to lodge a concern, confidentially and anonymously, about any accounting and auditing matter. Information about lodging such complaints or making such concerns known is contained in the Company’s Whistleblower Policy and Procedures, which is posted on our web site atwww.stoneridge.com.

Director Independence

The New York Stock Exchange (“NYSE”) rules require listed companies to have a Board of Directors comprised of at least a majority of independent directors. Under the NYSE rules, a director qualifies as “independent” upon the affirmative determination by the Board of Directors that the director has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company). The Board of Directors has determined that the following directors and nominees for election of director are independent:

The Board of Directors has not adopted categorical standards of independence. In making the independence determinations, the Board considered that Ms. Korth’s automotive consulting company IRN, Inc., was engaged by a division of the Company to provide consulting advice in the spring and summer of 2008. The amounts paid to Ms. Korth’s company were below the threshold that would (i) trigger disclosure under the heading “Transactions with Related Persons” or (ii) disqualify Ms. Korth from being independent under the NYSE’s rules. In addition, the Board also considered the prior relations of Mr. Kaplan and Mr. Schlather to Mr. Draime. Mr. Kaplan has from time to time represented Mr. Draime as his legal counsel. Mr. Schlather, while a partner at PricewaterhouseCoopers LLP, provided certain tax advice to Mr. Draime’s family.

5

The Board of Directors

In 2008, the Board of Directors held nine meetings and took action by unanimous written consent on two occasions. The Company’s policy is that directors attend the Annual Meeting of Shareholders. All directors attended the 2008 Annual Meeting of Shareholders. Mr. Lasky has been appointed as the presiding director by the non-management directors to preside at the executive sessions of the non-management and independent directors. It is the Board of Directors’ practice to have the non-management directors meet regularly in executive session and to have the independent directors meet at least once a year in executive session.

Committees of the Board

The Board has three standing committees to facilitate and assist the Board in the execution of its responsibilities. The committees are the Compensation Committee, the Audit Committee and the Nominating and Corporate Governance Committee. Each member of the Compensation, Audit, and Nominating and Corporate Governance committees is independent as defined under the listing standards of the NYSE. The table below shows the composition of the Board’s committees:

Compensation Committee.

This committee held six meetings during 2008. The Compensation Committee is responsible for establishing and reviewing our compensation philosophy and programs with respect to our executive officers, approving executive officer compensation and benefits and recommending to the Board the approval, amendment and termination of incentive compensation and equity based plans and certain other compensation matters, including director compensation. Recommendations regarding compensation of other officers are made to the Compensation Committee by our Chief Executive Officer (“CEO”). The Compensation Committee can exercise its discretion in modifying any amount presented by our CEO. The Compensation Committee regularly reviews tally sheets that detail the total compensation obligations to each of our executive officers. The Compensation Committee has retained Towers Perrin, an independent outside compensation consulting firm, to advise on all matters related to executive and director compensation. Specifically, Towers Perrin provides relevant market data, current trends in executive and director compensation and advice on program design. In accordance with its charter, the Compensation Committee may delegate power and authority as it deems appropriate for any purpose to a subcommittee of not fewer than two members.

Audit Committee.

This committee held nine meetings during 2008. Information regarding the functions performed by the Audit Committee is set forth in the “Audit Committee Report,” included in this proxy statement. The Board of Directors has determined that each Audit Committee member is financially literate under the current listing standards of the NYSE. The Board of Directors also determined that Mr. Epstein qualifies as an “audit committee financial expert” as defined by the SEC rules adopted pursuant to the Sarbanes-Oxley Act of 2002. In addition, under the Sarbanes-Oxley Act of 2002 and the NYSE rules mandated by the SEC, members of the audit committee must have no affiliation with the issuer, other than their Board seat, and receive no compensation in any capacity other than as a director or committee member. Each member of the Audit Committee meets this additional independence standard applicable to audit committee members of NYSE listed companies.

Nominating and Corporate Governance Committee.

This committee held two meetings in 2008. The purpose of the Nominating and Corporate Governance Committee is to evaluate and recommend candidates for election as directors, make recommendations concerning the size and composition of the Board of Directors, develop and implement the Company’s corporate governance policies and assess the effectiveness of the Board of Directors.

6

Nominations and Nomination Process

It is the policy of the Nominating and Corporate Governance Committee to consider individuals recommended by shareholders for membership on the Board of Directors. If a shareholder desires to recommend an individual for membership on the Board of Directors, then that shareholder must provide a written notice (the “Recommendation Notice”) to the Secretary of the Company at Stoneridge, Inc., 9400 East Market Street, Warren, Ohio 44484, on or before January 15 for consideration by this committee for that year’s election of directors at the Annual Meeting of Shareholders.

In addition, in order for a recommendation to be considered by the Nominating and Corporate Governance Committee, the Recommendation Notice must contain, at a minimum, the following:

The Nominating and Corporate Governance Committee determines, and periodically reviews with the Board of Directors, the desired skills and characteristics for directors as well as the composition of the Board of Directors as a whole. This assessment considers the directors’ qualifications and independence, as well as diversity, age, skill and experience in the context of the needs of the Board of Directors. At a minimum, directors should share the values of the Company and should possess the following characteristics: high personal and professional integrity; the ability to exercise sound business judgment; an inquiring mind; and the time available to devote to Board of Directors’ activities and the willingness to do so. In addition to the foregoing considerations, generally with respect to nominees recommended by shareholders, the Nominating and Corporate Governance Committee will evaluate such recommended nominees considering the additional information regarding them contained in the Recommendation Notices. When seeking candidates for the Board of Directors, the Nominating and Corporate Governance Committee may solicit suggestions from incumbent directors, management and third-party search firms. Ultimately, the Nominating and Corporate Governance Committee will recommend to the Board of Directors prospective nominees who the Nominating and Corporate Governance Committee believes will be effective, in conjunction with the other members of the Board of Directors, in collectively serving the long-term interests of the Company’s shareholders.

The Nominating and Corporate Governance Committee recommended to the Board of Directors each of the nominees identified in “Election of Directors” on page 4. The nominees Ira C. Kaplan and Paul J. Schlather were recommended to the Nominating and Corporate Governance Committee as candidates for

7

election to the Board of Directors by Jeffrey P. Draime, a Company shareholder and current member of the Board of Directors (see “Security Ownership of Certain Beneficial Owners and Management” and “Proposal One: Election of Directors”).

Compensation Committee Interlocks and Insider Participation

None of the members of the Board’s Compensation Committee has served as one of our officers or employees at any time. Additionally, no Compensation Committee interlocks existed during 2008.

Communications With the Board of Directors

The Board of Directors believes that it is important for interested parties to have a process to send communications to the Board of Directors. Accordingly, persons who wish to communicate with the Board of Directors may do so by sending a letter to the Secretary of the Company at Stoneridge, Inc., 9400 East Market Street, Warren, Ohio 44484. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Board Communication” or “Director Communication.” All such letters must identify the author and clearly state whether the intended recipients are all members of the Board of Directors or certain specified individual directors (such as the presiding director or non-management directors as a group). The Secretary will make copies of all such letters and circulate them to the appropriate director or directors. The directors are not spokespeople for the Company and responses or replies to any communication should not be expected.

Transactions With Related Persons

There were no reportable transactions involving related persons in 2008.

Review and Approval of Transactions With Related Persons

The Board has adopted a written statement of policy with respect to related party transactions. Under the policy, a related party transaction is a transaction required to be disclosed pursuant to Item 404 of Regulation S-K or any other similar transaction involving the Company and the Company’s subsidiaries and any Company employee, officer, director, 5% shareholder or an immediate family member of any of the foregoing if the dollar amount of the transaction or series of transactions exceeds $25,000. A related party transaction will not be prohibited merely because it is required to be disclosed or because it involves related parties. Pursuant to the policy, such transactions are presented to the Nominating and Corporate Governance Committee for evaluation and approval by the committee, or if the committee elects, by the full Board of Directors. If the transaction is determined to involve a related party, the Nominating and Corporate Governance Committee will either approve or disapprove the proposed transaction. Under the policy, in order to be approved, the proposed transaction must be on terms that are fair to the Company and are comparable to market rates, where applicable.

8

PROPOSAL TWO: RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2009

| 2008 | 2007 | |||||||

| Audit Fees | $ | 1,692,784 | $ | 1,731,227 | ||||

| Tax Fees | 482,130 | 102,434 | ||||||

| All Other Fees | 13,677 | 11,732 | ||||||

| Total | $ | 2,188,591 | $ | 1,845,393 | ||||

2010 2009 Audit Fees $ 1,606,726 $ 1,551,937 Tax Fees 284,033 501,029 All Other Fees 11,760 10,167 Total Fees $ 1,902,519 $ 2,063,133 including the audit of the effectivenessassessment of the Company’s internal control over financial reporting as integrated with the annual audit of the Company’s financial statements, the quarterly reviews of the financial statements included in the Company’s Form 10-Q filings, statutory and regulatory audits and general assistance with the implementation of new regulatory pronouncements.audits, tax compliance tax consulting and both domestic and international tax planning.

9

New York Stock Exchange (“NYSE”).

The Audit Committee

Sheldon J. Epstein, ChairmanDouglas C. JacobsWilliam M. Lasky

10

| The Audit Committee | |

| Douglas C. Jacobs, Chairman | |

| Ira C. Kaplan | |

| William M. Lasky | |

| Paul J. Schlather |

In addition, shareholders must reapprove the material terms every five years. On March 8, 2009,October 30, 2006, the Board of Directors, acting through the Compensation Committee, adopted a Long-Term Cash Incentive Plan (“LTCIP”) and made awards pursuant thereto. The LTCIP was adopted to supplement the annual grants of time-based restricted common shares under the Company’s equity-based Amended and Restated Long-Termwritten Annual Incentive Plan (the “LTIP”“AIP”). As described in Compensation Discussion and Analysis, over the last several years as part of the Company’s overall compensation program, performance-based restricted common shares and time-based restricted common shares, both with a three year vesting period, have been granted by the Committee, subject to shareholder approval. The AIP provides that the named executive officers and other key employees. Foremployees selected by the Compensation Committee are eligible to receive annual bonuses, payable in cash based on the level of attainment of Company and individual performance goals over one-year performance periods. The AIP was initially approved by shareholders on May 7, 2007 and permits awards of long-term performance-based compensation for 2009, as a resultto be granted through December 31, 2011. The Amended AIP will be effective January 1, 2012, extends the term of the currently depressed market price of the Company’s common shares, the resulting concerns regarding the dilutive effect of grants of performance-based restricted common shares at historical valuation levels,AIP for five years and the number of shares availableis now being submitted for issuance under the LTIP, the Company adopted the LTCIP to allow for the continuation of long-term performance-based incentive compensation using cash in lieu of equity. In 2009, grants of awards under the LTCIP were made in lieu of grants of performance-based restricted common shares under the LTIP.

For 2009, the awards under the LTCIP provide recipients with the right to receive cash after three years depending on the Company’s actual earnings per share (“EPS”) performance for a performance period comprised of the 2009, 2010 and 2011 fiscal years. The Company believes that linking potential long-term compensation to performance ties the executive officers’ overall compensation to returns to shareholders, which aligns executive officers’ interests with the Company’s shareholders’ interests. For 2009 grants, the performance period EPS performance target was established from the Company’s budgeted EPS with a 10% annual growth factor for years two and three. Minimum EPS was established at 50% of target and maximum EPS was established at 150% of target. The LTCIP shall continue until such time as it is terminatedreapproval by the Board of Directors. However, awards to the Company’s officers and key employees grantedshareholders.

Depending upon the Company’s EPS performance over the performance period as well as continued employment, the threshold, target and maximum amount that may be earned by the named executive officers, by all executive officers as a group and by all participating non-executive officer employees as a group under the LTCIP for awards made on March 8, 2009 are as follows:

| Threshold | Target | Maximum | ||||||||||

| John C. Corey | $ | 391,814 | $ | 783,628 | $ | 1,175,442 | ||||||

| George E. Strickler | 113,153 | 226,306 | 339,459 | |||||||||

| Mark J. Tervalon | 68,355 | 136,709 | 205,064 | |||||||||

| Thomas A. Beaver | 54,366 | 108,731 | 163,097 | |||||||||

| Martin Malmvik | 6,670 | 13,339 | 20,009 | |||||||||

| Executive Officers as a Group(1) | 627,688 | 1,255,374 | 1,883,062 | |||||||||

| Non-Executive Officer Employees as a Group(2) | 305,507 | 611,000 | 916,507 | |||||||||

11

The LTCIP is an unfunded plan and no provision will be made with respect to the segregating of assets by the Company for payment of benefits under the LTCIP. Income generally will not be recognized upon the grant of an award to a participant under the LTCIP. Upon payment in respect to any earned awards, the recipient generally will be required to include as taxable income in the year of the receipt an amount equal to the amount of cash received. All payments are intended to comply with the provisions of Section 409A of the Code.

Approval LTCIP

Recommendation In the event that the Amended AIP is not approved by shareholders, payments made to certain of the Board of Directors

The Board believes thatCompany’s executive officers outside the LTCIP is in the best interestsAmended AIP may not be deductible for federal income tax purposes under Section 162(m) of the Company and its shareholders. Accordingly, the Board recommends a vote FOR the approval of the LTCIP.

Internal Revenue Code.

Amended AIP

| Purpose |

Administration of the | The Compensation Committee (the “Committee”) | |

| Eligible Persons | Officers and other key employees of the Company or its | |

| Awards | An award is an amount payable in cash to a participant if one or more performance objectives are met | |

| Maximum Award | $ |

12

| Reduction and Increase of Awards | ||

| Establishment of Performance Objectives | The Committee | |

| Types of Performance Objectives | Performance |

| Termination of Employment | A participant | |

| Amendment or Termination of the | The Board of Directors may amend, modify or terminate the | |

| Term | No award may be granted under the Amended AIP for a performance year starting after December 31, 2016. | |

Shareholder Reapproval of the | Since the |

13

13

| Jeffrey P. Draime | Kim Korth |

| Douglas C. Jacobs | William M. Lasky |

| Ira C. Kaplan | Paul J. Schlather |

Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | ||

| Douglas C. Jacobs* | Jeffrey P. Draime | Jeffrey P. Draime | ||

| Ira C. Kaplan | Douglas C. Jacobs | Ira C. Kaplan | ||

| William M. Lasky | Kim Korth* | Kim Korth | ||

| Paul J. Schlather | William M. Lasky | William M. Lasky* |

| · | the name and address, as they appear on the Company’s books, and telephone number of the shareholder making the recommendation, including information on the number of common shares owned and date(s) acquired, and if such person is not a shareholder of record or if such common shares are owned by an entity, reasonable evidence of such person’s ownership of such shares or such person’s authority to act on behalf of such entity; |

| · | the full legal name, address and telephone number of the individual being recommended, together with a reasonably detailed description of the background, experience and qualifications of that individual; |

| · | a written acknowledgment by the individual being recommended that he or she has consented to the recommendation and consents to the Company undertaking an investigation into that individual’s background, experience and qualifications in the event that the Nominating and Corporate Governance Committee desires to do so; |

| · | any information not already provided about the person’s background, experience and qualifications necessary for the Company to prepare the disclosure required to be included in the Company’s proxy statement about the individual being recommended; |

| · | the disclosure of any relationship of the individual being recommended with the Company or any of its subsidiaries or affiliates, whether direct or indirect; and |

| · | the disclosure of any relation of the individual being recommended with the shareholder, whether direct or indirect, and, if known to the shareholder, any material interest of such shareholder or individual being recommended in any proposals or other business to be presented at the Company’s Annual Meeting of Shareholders (or a statement to the effect that no material interest is known to such shareholder). |

| · | attract and retain executive officers by providing a compensation package that is competitive with that offered by similarly situated companies; |

| · | create a compensation structure under which a substantial portion of total compensation is based on achievement of performance goals; and |

| · | align total compensation with the objectives and strategies of our business and shareholders. |

| Objective Addressed | |||||||

Type of Compensation | Competitive Compensation | Performance Objective | Retention | ||||

| Base salary | ü | ||||||

| Annual incentive plan awards | ü | ||||||

| Long-term cash incentive plan awards | ü | ü | ü | ||||

| Equity-based awards | ü | ü | |||||

| Benefits and perquisites | ü | ||||||

| Retention awards | ü | ||||||

Mix of Compensation

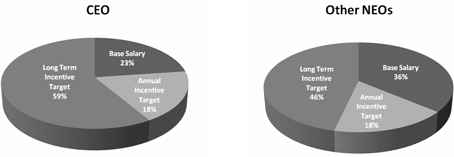

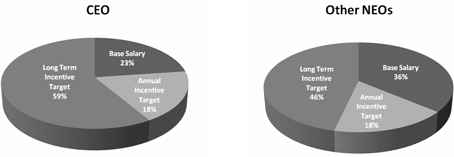

Our executive compensation is based on our “pay-for-performance”pay-for-performance philosophy, which emphasizes executive performance measures that correlate closely with the achievement of both shorter-term performance objectives and longer-term shareholder value. To this end, a substantial portion of our executive officers’ annual and long-term compensation is at-risk. The portion of compensation at-risk increases with the executive officer’s position level. This provides more upside potential and downside risk for more senior positions because these roles have greater influence on the performance of the Company as a whole. For 2008, an average

Total Target Compensation

Total target compensation is the value of approximately 40%the compensation package that is intended to be delivered if performance goals are met. Actual compensation depends on the annual and long-term incentive compensation payout levels based upon the applicable performance achievement and, for long-term awards, the price of our named executive officers’common shares. The following charts show the weighting of each element of total target compensation for the CEO and the other Named Executive Officers (“NEO”NEOs”) cash, excluding the one-time retention awards paid in 2010. These charts illustrate our pay-for-performance philosophy, as annual and long-term incentive compensation shown in our Summary Compensation Table consistedcomprises the majority of performance-basedtotal target compensation.19

Determination of Compensation

Determination of Compensation

Based on the foregoing objectives, we have structured the Company’s executive officers’ compensation to provide adequate competitive compensation to attract and retain executive officers, to motivate them to achieve our strategic goals and to reward the executive officers for achieving such goals. The Compensation Committee (the “Committee”) has retained the services of Towers Perrin, an outsideindependent compensation consultant to assist the Committee to fulfill various aspects of its charter. During fiscal year 2008, Towers Perrin assisted2010, the Committee with:retained Total Rewards Strategies to assist the Committee with the following: keeping it appraised about relevant trends and technical developments during its meetings,meetings; providing consulting advice regarding long-term incentive arrangementsand change in control arrangements; providing peer group analysis; and providing market data for the CEO position and other executive officers. Additionally, recommendations and evaluations from the CEO are considered by the Committee when setting the compensation of the other executive officers. The annual evaluation of the CEO by the Board of Directors is considered by the Committee when establishing the compensation of the CEO.

14

For 2008 compensation decisions, we considered general market movements derived from compensation data based on general industry data produced from Towers Perrin’s 2007 executive compensation database for base salary, annual incentive

| Esterline Technologies | ||||||

| Ametek | Gentek | Shiloh Industries | ||||

| Amphenol | Gentex | |||||

| Standard Motor Products | ||||||

| ATC Technology Corp | Superior Industries International | |||||

| AVX | Methode Electronics | Sypris Solutions | ||||

| Commercial Vehicle Group | Thomas & Betts | |||||

| CTS | Nu Horizons Electronics | Titan International | ||||

The peer group companies’ revenues range from $400 million to $1,400 million. Our revenue falls slightly below

targets are exceeded and will fall below target levels if overall financial goals are not achieved.

| · | Base salary; |

15

| · | Annual cash incentive awards; |

| · | Long-term cash-based incentive awards; |

| · | Long-term equity-based incentive awards; |

| · | Benefits and perquisites; and |

| · | One-time retention award made in 2009 paid in 2010. |

for 2010.

2010.

| Weight | Target Metric | Achievement | ||||||||||

| Operating profit | 35 | % | $ | 13.4 million | 200 | % | ||||||

| Return on invested capital | 20 | % | 4.02 | % | 200 | % | ||||||

| Free cash flow | 20 | % | $ | (26.3) million | 200 | % | ||||||

| Sales growth | 25 | % | $ | 150.0 million | 200 | % | ||||||

| AIP Target (Percent of Base Salary) | Consolidated Financial Performance | Business Unit Financial Performance | Personal Performance | AIP Achievement (Percent of Target) | ||||||||||||||||

| John C. Corey | 80 | % | 70 | % | — | 30 | % | 94 | % | |||||||||||

| George E. Strickler | 55 | % | 70 | % | — | 30 | % | 107 | % | |||||||||||

| Thomas A. Beaver | 45 | % | 60 | % | 20 | % | 20 | % | 123 | % | ||||||||||

| Mark J. Tervalon | 45 | % | 60 | % | 20 | % | 20 | % | 120 | % | ||||||||||

| Martin Malmvik | 29 | % | 50 | % | 30 | % | 20 | % | 128 | % | ||||||||||

Target (Percent of Base Salary) | Target | Achieved | ||||||||||

| John C. Corey | 80 | % | $ | 528,000 | $ | 1,056,000 | ||||||

| George E. Strickler | 55 | % | 189,200 | 378,400 | ||||||||

| Mark J. Tervalon | 45 | % | 135,315 | 270,630 | ||||||||

| Thomas A. Beaver | 45 | % | 126,585 | 253,170 | ||||||||

| Michael D. Sloan | 45 | % | 101,250 | 202,500 | ||||||||

16

Performance-Based Restricted Shares. We believe that linkingtime-based restricted common share grantsshares is included in the “Stock Awards” column of the Summary Compensation Table. The time-based restricted common shares awarded in 2010 are included in the “All Other Stock Awards” column of the Grants of Plan-Based Awards table.

| ATC Technology Corp | Gentex | Pulse Electronics |

| AVX | Graco | Shiloh Industries |

| Commercial Vehicle Group | Methode Electronics | Standard Motor Products |

| CTS | Modine Manufacturing | Superior Industries International |

| Esterline Technologies | Nu Horizons Electronics | Thomas & Betts |

| Titan International |

Time-Based Restricted Shares.

Timing of Grants. It is the intent of the CommitteeCommittee’s practice has been to approve the awards under the LTIP and LTCIP at the first regular meeting of the year; awardscalendar year. Awards in 2010 were granted at the March 20082010 meeting, for 2008.the first regularly scheduled meeting. As a general practice, awards under the LTIP and LTCIP are approved only once a year unless a situation arises whereby a compensation package is approved for a newly hired or promoted executive officer and equity-based compensation is a component.

17

on an annual basis. Mr. Corey was awarded 150,000 restricted common shares under the Company’s LTIP, which vested over three years and are no longer subject to risk of forfeiture.

In addition, if Mr. Corey is terminated by the Company without cause, the Company will be obligated to provide as severance the same compensation and benefits described below under “Potential Change in Control and Other Post-Employment Payments.”

In January 2007, in accordance with Swedish practices, the Company entered into an employment agreement with Mr. Malmvik that provided for a base salary of $232,725; additional monthly contribution to a pension plan of $1,480; car allowance in accordance with company policy and a bonus program per company policy.

Executive

Employees’ Deferred Compensation Plan.

18

The Compensation Committee

Earl L. Linehan, ChairmanKim KorthWilliam M. Lasky

19

| The Compensation Committee |

| Kim Korth, Chairwoman |

| Jeffrey P. Draime |

| Douglas C. Jacobs |

| William M. Lasky |

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($)(3) | Non-Equity Incentive Plan Compensation ($)(4) | All Other Compensation ($)(5) | Total ($) | |||||||||||||||||||||

| John C. Corey President & Chief Executive Officer | 2008 | $ | 640,000 | $ | — | $ | 849,896 | $ | 480,768 | $ | 85,679 | $ | 2,056,343 | |||||||||||||||

| 2007 | 610,000 | — | 631,775 | 537,532 | 86,467 | 1,865,774 | ||||||||||||||||||||||

| 2006 | 505,527 | 250,000 | (2) | 793,735 | 116,495 | 234,174 | 1,899,931 | |||||||||||||||||||||

| George E. Strickler Executive Vice President, Chief Financial Officer & Treasurer | 2008 | 330,750 | — | 272,717 | 194,359 | 35,325 | 833,151 | |||||||||||||||||||||

| 2007 | 315,000 | — | 176,179 | 211,625 | 30,397 | 733,201 | ||||||||||||||||||||||

| 2006 | 292,341 | — | 84,486 | 117,677 | 26,511 | 521,015 | ||||||||||||||||||||||

| Mark J. Tervalon Vice President & President of the Stoneridge Electronics Division | 2008 | 292,000 | — | 154,850 | 157,943 | 22,368 | 627,161 | |||||||||||||||||||||

| 2007 | 278,250 | — | 108,781 | 128,336 | 45,280 | 560,647 | ||||||||||||||||||||||

| 2006 | 254,912 | (1) | — | 67,701 | 110,492 | 17,054 | 450,159 | |||||||||||||||||||||

| Thomas A. Beaver Vice President of Global Sales & Systems Engineering | 2008 | 274,500 | — | 121,723 | 151,565 | 30,902 | 578,690 | |||||||||||||||||||||

| 2007 | 267,800 | — | 89,650 | 168,352 | 26,765 | 552,567 | ||||||||||||||||||||||

| 2006 | 260,000 | — | 61,708 | 137,046 | 17,662 | 476,416 | ||||||||||||||||||||||

| Martin Malmvik Vice President & Managing Director of Stoneridge Electronics OEM | 2008 | 250,050 | — | 23,597 | 136,191 | 33,657 | 443,495 | |||||||||||||||||||||

| 2007 | 232,725 | — | 22,071 | 88,853 | 30,582 | 374,231 | ||||||||||||||||||||||

| 2006 | 205,054 | — | 14,458 | 60,344 | 26,775 | 306,631 | ||||||||||||||||||||||

Name and Principal Position | Year | Salary ($) | Stock Awards ($)(1) | Non-Equity Incentive Plan Compensation ($)(2) | All Other Compensation ($)(3) | Total ($) | ||||||||||||||||

| John C. Corey | 2010 | $ | 655,000 | $ | 1,296,116 | $ | 1,056,000 | $ | 707,557 | $ | 3,714,673 | |||||||||||

| President & Chief | 2009 | 615,439 | 304,372 | 204,800 | 71,799 | 1,196,410 | ||||||||||||||||

| Executive Officer | 2008 | 640,000 | 1,310,709 | 480,768 | 85,679 | 2,517,156 | ||||||||||||||||

| George E. Strickler | 2010 | 340,688 | 432,500 | 378,400 | 353,335 | 1,504,923 | ||||||||||||||||

| Executive Vice President, | 2009 | 324,430 | 87,907 | 72,765 | 27,290 | 512,392 | ||||||||||||||||

| Chief Financial Officer & Treasurer | 2008 | 330,750 | 379,104 | 194,359 | 35,325 | 939,538 | ||||||||||||||||

| Mark J. Tervalon | 2010 | 298,525 | 289,948 | 270,630 | 153,199 | 1,012,302 | ||||||||||||||||

| Vice President & President | 2009 | 283,987 | 53,091 | 52,560 | 21,995 | 411,633 | ||||||||||||||||

| of the Stoneridge Electronics Division | 2008 | 292,000 | 228,324 | 157,943 | 22,368 | 700,635 | ||||||||||||||||

| Thomas A. Beaver | 2010 | 279,600 | 238,740 | 253,170 | 154,508 | 926,018 | ||||||||||||||||

| Vice President of Global | 2009 | 269,221 | 42,244 | 49,410 | 20,985 | 381,860 | ||||||||||||||||

| Sales & Systems Engineering | 2008 | 274,500 | 182,013 | 151,565 | 30,902 | 638,980 | ||||||||||||||||

| Michael D. Sloan | 2010 | 219,790 | 166,080 | 202,500 | 105,312 | 693,682 | ||||||||||||||||

| Vice President & President | 2009 | 203,500 | 22,769 | 36,630 | 3,291 | 266,190 | ||||||||||||||||

| of the Stoneridge Control Devices Division | 2008 | 202,972 | 51,101 | 61,813 | 11,558 | 327,444 | ||||||||||||||||

| (1) |

| The amounts included in the “Stock Awards” column represent the |

Time Based | Target Performance Based | Maximum Performance Based | ||||||||||

| Mr. Corey | $ | 628,968 | $ | 681,741 | $ | 1,022,612 | ||||||

| Mr. Strickler | 182,013 | 197,091 | 295,637 | |||||||||

| Mr. Tervalon | 109,854 | 118,470 | 177,705 | |||||||||

| Mr. Beaver | 87,237 | 94,776 | 142,164 | |||||||||

| Mr. Sloan | 47,388 | 50,619 | 75,929 | |||||||||

| The amount shown for each NEO in the “Non-Equity Incentive Plan Compensation” column is attributable to an annual incentive award earned under the AIP in the fiscal year |

| The amounts shown for |

| Auto Allowance | 401(k) Contribution | Pension Contribution | Life Insurance | Gross-Up on Life Insurance | Healthcare Costs | Gross-Up on Healthcare Costs | Group Term Life Insurance | Club Dues | Other | Total | ||||||||||||||||||||||||||||||||||

| Mr. Corey | $ | 14,400 | $ | 10,022 | $ | — | $ | 14,056 | $ | 9,900 | $ | 6,629 | $ | 4,669 | $ | 7,524 | $ | 15,565 | $ | 2,914 | $ | 85,679 | ||||||||||||||||||||||

| Mr. Strickler | 9,000 | 11,783 | — | — | — | — | — | 4,847 | 5,895 | 3,800 | 35,325 | |||||||||||||||||||||||||||||||||

| Mr. Tervalon | — | 12,948 | — | — | — | — | — | 240 | 5,380 | 3,800 | 22,368 | |||||||||||||||||||||||||||||||||

| Mr. Beaver | 14,400 | 14,199 | — | — | — | — | — | 1,032 | — | 1,271 | 30,902 | |||||||||||||||||||||||||||||||||

| Mr. Malmvik | 15,472 | — | 18,185 | — | — | — | — | — | — | — | 33,657 | |||||||||||||||||||||||||||||||||

20

Auto Allowance | Life Insurance | Gross-Up on Life Insurance | Healthcare Costs | Gross-Up on Healthcare Costs | Group Term Life Insurance | Club Dues | Retention Award | Health Insurance Premium | Total | |||||||||||||||||||||||||||||||

| Mr. Corey | $ | 14,400 | $ | 14,056 | $ | 9,900 | $ | 7,917 | $ | 5,576 | $ | 7,524 | $ | 5,174 | $ | 640,000 | $ | 3,010 | $ | 707,557 | ||||||||||||||||||||

| Mr. Strickler | 9,000 | - | - | - | - | 4,847 | 5,000 | 330,750 | 3,738 | 353,335 | ||||||||||||||||||||||||||||||

| Mr. Tervalon | - | - | - | - | - | 240 | 1,374 | 146,000 | 5,585 | 153,199 | ||||||||||||||||||||||||||||||

| Mr. Beaver | 14,400 | - | - | - | - | 1,032 | - | 137,250 | 1,826 | 154,508 | ||||||||||||||||||||||||||||||

| Mr. Sloan | - | - | - | - | - | 552 | - | 101,750 | 3,010 | 105,312 | ||||||||||||||||||||||||||||||

| Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | Estimated Future Payouts Under Equity Incentive Plan Awards(2) | All Other Stock Awards: Number of Shares of Stock or Units (#)(3) | Grant Date Fair Value of Stock and Option Awards ($)(4) | |||||||||||||||||||||||||||||||||

| Name | Grant Date | Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | |||||||||||||||||||||||||||||

| John C. Corey | $ | 256,000 | $ | 512,000 | $ | 1,024,000 | ||||||||||||||||||||||||||||||

| 3/2/08 | 31,650 | 63,300 | 94,950 | 58,400 | $ | 1,651,580 | ||||||||||||||||||||||||||||||

| George E. Strickler | 90,956 | 181,913 | 363,825 | |||||||||||||||||||||||||||||||||

| 3/2/08 | 9,150 | 18,300 | 27,450 | 16,900 | 477,650 | |||||||||||||||||||||||||||||||

| Mark J. Tervalon | 65,700 | 131,400 | 262,800 | |||||||||||||||||||||||||||||||||

| 3/2/08 | 5,500 | 11,000 | 16,500 | 10,200 | 287,559 | |||||||||||||||||||||||||||||||

| Thomas A. Beaver | 61,763 | 123,525 | 247,050 | |||||||||||||||||||||||||||||||||

| 3/2/08 | 4,400 | 8,800 | 13,200 | 8,100 | 229,401 | |||||||||||||||||||||||||||||||

| Martin Malmvik | 35,734 | 71,469 | 142,937 | |||||||||||||||||||||||||||||||||

| 3/2/08 | 750 | 1,500 | 2,250 | 1,400 | 39,311 | |||||||||||||||||||||||||||||||

Estimated Future Payouts Under Non-Equity Incentive Plan Awards (1) | Estimated Future Payouts Under Equity Incentive Plan Awards (2) | All Other Stock Awards: Number of | Grant Date Fair Value of | |||||||||||||||||||||||||||||||

| Name | Grant Date | Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | Shares of Stock or Units (#)(3) | Stock and Option Awards ($)(4) | |||||||||||||||||||||||||

| John C. Corey | $ | 264,000 | $ | 528,000 | $ | 1,056,000 | ||||||||||||||||||||||||||||

| 2/14/2010 | 32,850 | 65,700 | 98,550 | 121,600 | $ | 1,296,116 | ||||||||||||||||||||||||||||

| 27,950 | 55,900 | 83,850 | 386,828 | |||||||||||||||||||||||||||||||

| George E. Strickler | 94,600 | 189,200 | 378,400 | |||||||||||||||||||||||||||||||

| 2/14/2010 | 10,950 | 21,900 | 32,850 | 40,600 | 432,500 | |||||||||||||||||||||||||||||

| 9,350 | 18,700 | 28,050 | 129,404 | |||||||||||||||||||||||||||||||

| Mark J. Tervalon | 67,658 | 135,315 | 270,630 | |||||||||||||||||||||||||||||||

| 2/14/2010 | 7,350 | 14,700 | 22,050 | 27,200 | 289,948 | |||||||||||||||||||||||||||||

| 6,250 | 12,500 | 18,750 | 86,500 | |||||||||||||||||||||||||||||||

| Thomas A. Beaver | 63,293 | 126,585 | 253,170 | |||||||||||||||||||||||||||||||

| 2/14/2010 | 6,050 | 12,100 | 18,150 | 22,400 | 238,740 | |||||||||||||||||||||||||||||

| 5,150 | 10,300 | 15,450 | 71,276 | |||||||||||||||||||||||||||||||

| Michael D. Sloan | 50,625 | 101,250 | 202,500 | |||||||||||||||||||||||||||||||

| 2/14/2010 | 4,200 | 8,400 | 12,600 | 15,600 | 166,080 | |||||||||||||||||||||||||||||

| 3,600 | 7,200 | 10,800 | 49,824 | |||||||||||||||||||||||||||||||

| (1) | The amounts shown reflect awards granted under the Company’s |

| (2) | The amounts shown reflect grants |

| (3) | The amounts shown reflect grants of time-based restricted common shares (“TBRS”) under the Company’s LTIP. The TBRS granted on |

| (4) | The amounts included in “Fair Value of Awards” column represent the aggregate grant date fair value of the awards computed in accordance with |

21

Outstanding Equity Awards at Year-End

| Option Awards | Stock Awards | |||||||||||||||||||||||||||

| Name | Number of Securities Underlying Unexercised Options Exercisable (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock that have Not Vested (#) | Market Value of Shares or Units of Stock that have Not Vested ($)(1) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights that have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights that have Not Vested ($)(1) | |||||||||||||||||||||

| John C. Corey | 10,000 | $ | 15.725 | 5/10/2014 | 37,500 | (4) | $ | 171,000 | 82,500 | (8) | $ | 376,200 | ||||||||||||||||

| 55,000 | (5) | 250,800 | 78,600 | (9) | 358,416 | |||||||||||||||||||||||

| 52,400 | (6) | 238,944 | 94,950 | (10) | 432,972 | |||||||||||||||||||||||

| 58,400 | (7) | 266,304 | ||||||||||||||||||||||||||

| George E. Strickler | — | — | — | 5,000 | (3) | 22,800 | 41,250 | (8) | 188,100 | |||||||||||||||||||

| 27,500 | (5) | 125,400 | 21,000 | (9) | 95,760 | |||||||||||||||||||||||

| 14,000 | (6) | 63,840 | 27,450 | (10) | 125,172 | |||||||||||||||||||||||

| 16,900 | (7) | 77,064 | ||||||||||||||||||||||||||

| Mark J. Tervalon | 4,000 | 10.385 | 2/4/2013 | 1,425 | (2) | 6,498 | 18,750 | (8) | 85,500 | |||||||||||||||||||

| 12,500 | (5) | 57,000 | 14,250 | (9) | 64,980 | |||||||||||||||||||||||

| 9,500 | (6) | 43,320 | 16,500 | (10) | 75,240 | |||||||||||||||||||||||

| 10,200 | (7) | 46,512 | ||||||||||||||||||||||||||

| Thomas A. Beaver | 20,000 | 10.385 | 2/4/2013 | 1,425 | (2) | 6,498 | 13,875 | (8) | 63,270 | |||||||||||||||||||

| 9,250 | (5) | 42,180 | 11,625 | (9) | 53,010 | |||||||||||||||||||||||

| 7,750 | (6) | 35,340 | 13,200 | (10) | 60,192 | |||||||||||||||||||||||

| 8,100 | (7) | 36,936 | ||||||||||||||||||||||||||

| Martin Malmvik | 1,000 | 14.72 | 4/15/2009 | 350 | (2) | 1,596 | 3,525 | (8) | 16,074 | |||||||||||||||||||

| 2,350 | (5) | 10,716 | 2,250 | (9) | 10,260 | |||||||||||||||||||||||

| 1,500 | (6) | 6,840 | 2,250 | (10) | 10,260 | |||||||||||||||||||||||

| 1,400 | (7) | 6,384 | ||||||||||||||||||||||||||

| Option Awards | Stock Awards | |||||||||||||||||||||||||||

| Name | Number of Securities Underlying Unexercised Options Exercisable (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($)(1) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(1) | |||||||||||||||||||||

| John C. Corey | 10,000 | $ | 15.725 | 5/10/2014 | 58,400 | (2) | $ | 922,136 | 94,950 | (5) | $ | 1,499,261 | ||||||||||||||||

| 170,040 | (3) | 2,684,932 | 98,550 | (6) | 1,556,105 | |||||||||||||||||||||||

| 121,600 | (4) | 1,920,064 | 83,850 | (7) | 1,323,992 | |||||||||||||||||||||||

| George E. Strickler | - | - | - | 16,900 | (2) | 266,851 | 27,450 | (5) | 433,436 | |||||||||||||||||||

| 49,110 | (3) | 775,447 | 32,850 | (6) | 518,702 | |||||||||||||||||||||||

| 40,600 | (4) | 641,074 | 28,050 | (7) | 442,910 | |||||||||||||||||||||||

| Mark J. Tervalon | 4,000 | 10.385 | 2/4/2013 | 10,200 | (2) | 161,058 | 16,500 | (5) | 260,535 | |||||||||||||||||||

| 29,660 | (3) | 468,331 | 22,050 | (6) | 348,170 | |||||||||||||||||||||||

| 27,200 | (4) | 429,488 | 18,750 | (7) | 296,063 | |||||||||||||||||||||||

| Thomas A. Beaver | 20,000 | 10.385 | 2/4/2013 | 8,100 | (2) | 127,899 | 13,200 | (5) | 208,428 | |||||||||||||||||||

| 23,600 | (3) | 372,644 | 18,150 | (6) | 286,589 | |||||||||||||||||||||||

| 22,400 | (4) | 353,696 | 15,450 | (7) | 243,956 | |||||||||||||||||||||||

| Michael D. Sloan | - | - | - | 4,400 | (2) | 69,476 | 7,050 | (5) | 111,320 | |||||||||||||||||||

| 12,720 | (3) | 200,849 | 12,600 | (6) | 198,954 | |||||||||||||||||||||||

| 15,600 | (4) | 246,324 | 10,800 | (7) | 170,532 | |||||||||||||||||||||||

| (1) | Based on the closing price of the Company’s common shares on December 31, |

| (2) |

22

| (6) | These performance-based restricted common shares are scheduled to vest on February 14, 2013 subject to achievement of specified financial performance metrics. |

| (7) | These phantom shares are scheduled to vest on February 14, 2013 subject to achievement of specified financial performance metrics. |

| Option Awards | Stock Awards | |||||||||||||||

| Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise($) | Number of Shares Acquired on Vesting (#) | Value Realized on Vesting ($) | ||||||||||||

| John C. Corey | — | $ | — | 37,500 | $ | 266,625 | ||||||||||

| George E. Strickler | — | — | 2,500 | 18,525 | ||||||||||||

| Mark J. Tervalon | — | — | 4,225 | 59,158 | ||||||||||||

| Thomas A. Beaver | 25,000 | 215,185 | 4,225 | 59,158 | ||||||||||||

| Martin Malmvik | — | — | 2,000 | 28,000 | ||||||||||||

Stock Awards Name Number of SharesAcquired onVesting (#) Value Realizedon Vesting ($) John C. Corey 52,400 $ 420,510 George E. Strickler 16,500 134,850 Mark J. Tervalon 9,500 76,238 Thomas A. Beaver 7,750 62,194 Michael D. Sloan 5,000 40,125

Nonqualified Deferred Compensation for Fiscal Year 20082010

Name Executive

Contributions in Last FY ($) Aggregate

Earnings in

Last FY ($) Aggregate

Balance at

Last FYE ($) John C. Corey $ 268,766 $ 26,820 $ 492,361 George E. Strickler — — — Mark J. Tervalon — 671 10,542 Thomas A. Beaver — — — Martin Malmvik — — —

| Stock Awards | ||||||||

| Name | Number of Shares Acquired on Vesting (#) | Value Realized on Vesting ($) | ||||||

| John C. Corey | 52,400 | $ | 420,510 | |||||

| George E. Strickler | 16,500 | 134,850 | ||||||

| Mark J. Tervalon | 9,500 | 76,238 | ||||||

| Thomas A. Beaver | 7,750 | 62,194 | ||||||

| Michael D. Sloan | 5,000 | 40,125 | ||||||

| Name | Executive Contributions in Last FY ($) | Aggregate Earnings in Last FY ($) | Aggregate Balance at Last FYE ($) | |||||||||

| John C. Corey | $ | 268,766 | $ | 26,820 | $ | 492,361 | ||||||

| George E. Strickler | — | — | — | |||||||||

| Mark J. Tervalon | — | 671 | 10,542 | |||||||||

| Thomas A. Beaver | — | — | — | |||||||||

| Martin Malmvik | — | — | — | |||||||||

Mr. Corey deferred a portion of his annual incentive payment earned in 2007, paid in 2008.

Name AggregateEarnings inLast FY ($) AggregateWithdrawals/Distributions ($) AggregateBalance atLast FYE ($) John C. Corey $ 22,115 $ 535,678 $ - George E. Strickler - - - Mark J. Tervalon 473 11,469 - Thomas A. Beaver - - - Michael D. Sloan - - -

Potential Change in Control and Other Post-Employment Payments

In July 2007, we entered into an Amended and Restated Change in Control Agreement (the “CIC Agreement”) with each NEO except Mr. Malmvik, and certain other senior management employees. Our change in control agreements were designed to provide for continuity of management in the event of change in control of the Company. We think it is important for our executives to be able to react neutrally to a potential change in control and not be influenced by personal financial concerns. We believe our arrangements are consistent with market practice. WeFor our NEOs, we set the level of benefits at two times base salary and average incentive award (described in detail below) to remain competitive with our select peer group. Finally, all payments under the CIC Agreement are conditioned on a no-compete,non-compete, non-solicitation and non-disparagement agreement. The change in control agreementsCIC Agreements replaced and superseded change in control agreements we previously entered into with these employees. The Committee determined that amending and restating prior agreements was necessary to comply with recently adopted final regulation under Code Section 409A of the Code, to add a non-competition clause for our protection, to address ambiguity in the prior agreements and to add a conditional gross up of any excise tax imposed under Code Section 280G.280G of the Internal Revenue Code. In December 2008, we amended the CIC Agreement to comply with the requirements of Revenue RuleRuling 2008-13, which requirerequires that all payments to executives toan executive be based on actual results for performance basedperformance-based payments.

We believe that the CIC Agreements should compensate executives displaced by a change in control and not serve as an incentive to increase personal wealth. Therefore, our CIC Agreements are “double trigger” arrangements. In order for the executives to receive the payments and benefits set forth in the agreement, both of the following must occur:a change in control of the Company; anda triggering event:

the Company separates NEO from service, other than in the case of a termination for cause, within two years of the change in control; or· a change in control of the Company; and

NEO separates from service for good reason (defined as material reduction in NEO’s title, responsibilities, power or authority, or assignment of duties that are materially inconsistent to previous duties, or material reduction in NEO’s compensation and benefits, or require NEO to work from any location more than 100 miles from previous location) within two years of the change in control.29

23

· a triggering event:

· the Company separates NEO from service, other than in the case of a termination for cause, within two years of the change in control; or

· NEO separates from service for good reason (defined as material reduction in NEO’s title, responsibilities, power or authority, or assignment of duties that are materially inconsistent to previous duties, or material reduction in NEO’s compensation and benefits, or require NEO to work from any location more than 100 miles from previous location) within two years of the change in control.

If the events listed above occur and the executive delivers a release to the Company, the Company will be obligated to provide the following to the executive:two times the greater of the NEO’s annual base salary at the time of a triggering event or at the time of the occurrence of a change in control;two times the greater of the NEO’s average annual incentive award over the last three completed fiscal years or the last five completed fiscal years;

an amount equal to the pro rata amount of annual incentive compensation the NEO would have been entitled to at the time of a triggering event calculated based on the performance goals that were achieved in the year in which the triggering event occurred;· two times the greater of the NEO’s annual base salary at the time of a triggering event or at the time of the occurrence of a change in control;

continued life and health insurance benefits for twenty-four months following termination; and· two times the greater of the NEO’s average annual incentive award over the last three completed fiscal years or the last five completed fiscal years;

a gross-up payment to provide the NEO with an amount, on an after-tax basis, equal to any excise taxes payable by the NEO under tax laws in connection with payments described above. However, if the NEO’s total payments described above fall above the 280G limit (within the meaning of Code Section 280G) by 110% or less, then the total payments will be reduced to avoid triggering excise tax.· an amount equal to the pro rata amount of annual incentive compensation the NEO would have been entitled to at the time of a triggering event calculated based on the performance goals that were achieved in the year in which the triggering event occurred;

· continued life and health insurance benefits for twenty-four months following termination; and

· a gross-up payment to provide the NEO with an amount, on an after-tax basis, equal to any excise taxes payable by the NEO under tax laws in connection with payments described above. However, if the NEO’s total payments described above fall above the 280G limit (within the meaning of Section 280G of the Code) by 110% or less, then the total payments will be reduced to avoid triggering excise tax.

Upon a change in control as defined in the LTIP, the restricted common shares included on the “Outstanding Equity Awards at Year-End” table that are not performance-based vest and are no longer subject to forfeiture; the performance-based restricted common shares included on the “Outstanding Equity Awards at Year End” table vest and are no longer subject to forfeiture based on target achievement levels.

In October 2009, the Company adopted the Officers’ and Key Employees’ Severance Plan (the “Severance Plan”). The named executive officers covered under the Severance Plan include Messrs. Strickler, Tervalon, Beaver and Sloan. If a covered executive is terminated by the Company without cause, the Company will be obligated under the Severance Plan to pay the executive’s salary for 12 months (18 months in the case of the Chief Financial Officer, Mr. Strickler) and continue health and welfare benefits coverage over the same period of time. Mr. Corey’s severance protection is provided in his employment agreement as described above.

No severance is payable if the NEO’s employment is terminated for “cause,” if they resign, or if they die.upon death.

Value of Payment Presuming Hypothetical December 31, 20082010 Termination Date

Upon resignation, no payments are due to any NEO in the table below. Assuming the events described in the table below occurred on December 31, 2008,2010, each NEO would be eligible for the following payments and benefits:

Resignation Termination

Without

Cause Change in Control and NEO Resigns for Good Reason or is Terminated Without Cause Disability Death John C. Corey

Base Salary $ — $ 1,280,000 $ 1,280,000 $ 160,000 $ — Annual Incentive Award — 923,197 1,018,300 — — Unvested and Accelerated Restricted Shares — 593,02 31,103,205 421,800 421,800 Unvested and Accelerated Performance Shares — — 527,592 428,231 428,231 Deferred Compensation Plan 492,361 492,361 492,361 492,361 492,361 Health & Welfare Benefits — 60,656 60,656 — — Tax Gross-Up — — — — — Total $ 492,361 $ 3,349,237 $ 4,482,114 $ 1,502,392 $ 1,342,392

24

Resignation Termination

Without

Cause Change in Control and NEO Resigns for Good Reason or is Terminated Without Cause Disability or Death George E. Strickler

Base Salary $ — $ — $ 661,500 $ — Annual Incentive Award — — 405,984 — Unvested and Accelerated Restricted Shares — 184,229 377,180 136,800 Unvested and Accelerated Performance Shares — — 147,288 163,204 Deferred Compensation Plan — — — — Health & Welfare Benefits — — 35,518 — Tax Gross-Up — — 496,535 — Total $ — $ 184,229 $ 2,124,005 $ 300,004 Thomas A. Beaver

Base Salary $ — $ — $ 549,000 $ — Annual Incentive Award — — 304,643 — Unvested and Accelerated Restricted Shares — 72,331 150,580 48,678 Unvested and Accelerated Performance Shares — — 75,468 66,719 Deferred Compensation Plan — — — — Health & Welfare Benefits — — 13,608 — Tax Gross-Up — — — — Total $ — $ 72,331 $ 1,093,299 $ 115,397 Mark J. Tervalon

Base Salary $ — $ — $ 559,446 $ — Annual Incentive Award — — 264,514 — Unvested and Accelerated Restricted Shares — 91,802 193,367 63,498 Unvested and Accelerated Performance Shares — — 93,480 86,319 Deferred Compensation Plan 10,541 10,541 10,541 10,541 Health & Welfare Benefits — — 34,929 — Tax Gross-Up — — — — Total $ 10,541 $ 102,343 $ 1,156,277 $ 160,358 Martin Malmvik

Base Salary $ — $ 500,099 $ — $ — Annual Incentive Award — — — — Unvested and Accelerated Restricted Shares — 16,174 33,065 12,312 Unvested and Accelerated Performance Shares — — 13,680 14,709 Deferred Compensation Plan — — — — Health & Welfare Benefits — 67,314 67,314 — Tax Gross-Up — — — — Total $ — $ 583,587 $ 114,059 $ 27,021

25

30Directors’ Compensation

| Name | Aggregate Earnings in Last FY ($) | Aggregate Withdrawals/ Distributions ($) | Aggregate Balance at Last FYE ($) | |||||||||

| John C. Corey | $ | 22,115 | $ | 535,678 | $ | - | ||||||

| George E. Strickler | - | - | - | |||||||||

| Mark J. Tervalon | 473 | 11,469 | - | |||||||||

| Thomas A. Beaver | - | - | - | |||||||||

| Michael D. Sloan | - | - | - | |||||||||

| · | a change in control of the Company; and |

23

| · | a triggering event: |

| · | the Company separates NEO from service, other than in the case of a termination for cause, within two years of the change in control; or |

| · | NEO separates from service for good reason (defined as material reduction in NEO’s title, responsibilities, power or authority, or assignment of duties that are materially inconsistent to previous duties, or material reduction in NEO’s compensation and benefits, or require NEO to work from any location more than 100 miles from previous location) within two years of the change in control. |

| · | two times the greater of the NEO’s annual base salary at the time of a triggering event or at the time of the occurrence of a change in control; |

| · | two times the greater of the NEO’s average annual incentive award over the last three completed fiscal years or the last five completed fiscal years; |

| · | an amount equal to the pro rata amount of annual incentive compensation the NEO would have been entitled to at the time of a triggering event calculated based on the performance goals that were achieved in the year in which the triggering event occurred; |

| · | continued life and health insurance benefits for twenty-four months following termination; and |

| · | a gross-up payment to provide the NEO with an amount, on an after-tax basis, equal to any excise taxes payable by the NEO under tax laws in connection with payments described above. However, if the NEO’s total payments described above fall above the 280G limit (within the meaning of Section 280G of the Code) by 110% or less, then the total payments will be reduced to avoid triggering excise tax. |

upon death.

| Resignation | Termination Without Cause | Change in Control and NEO Resigns for Good Reason or is Terminated Without Cause | Disability | Death | ||||||||||||||||

| John C. Corey | ||||||||||||||||||||

| Base Salary | $ | — | $ | 1,280,000 | $ | 1,280,000 | $ | 160,000 | $ | — | ||||||||||

| Annual Incentive Award | — | 923,197 | 1,018,300 | — | — | |||||||||||||||

| Unvested and Accelerated Restricted Shares | — | 593,02 | 31,103,205 | 421,800 | 421,800 | |||||||||||||||

| Unvested and Accelerated Performance Shares | — | — | 527,592 | 428,231 | 428,231 | |||||||||||||||

| Deferred Compensation Plan | 492,361 | 492,361 | 492,361 | 492,361 | 492,361 | |||||||||||||||

| Health & Welfare Benefits | — | 60,656 | 60,656 | — | — | |||||||||||||||

| Tax Gross-Up | — | — | — | — | — | |||||||||||||||

| Total | $ | 492,361 | $ | 3,349,237 | $ | 4,482,114 | $ | 1,502,392 | $ | 1,342,392 | ||||||||||

24

| Resignation | Termination Without Cause | Change in Control and NEO Resigns for Good Reason or is Terminated Without Cause | Disability or Death | |||||||||||||

| George E. Strickler | ||||||||||||||||

| Base Salary | $ | — | $ | — | $ | 661,500 | $ | — | ||||||||

| Annual Incentive Award | — | — | 405,984 | — | ||||||||||||

| Unvested and Accelerated Restricted Shares | — | 184,229 | 377,180 | 136,800 | ||||||||||||

| Unvested and Accelerated Performance Shares | — | — | 147,288 | 163,204 | ||||||||||||

| Deferred Compensation Plan | — | — | — | — | ||||||||||||

| Health & Welfare Benefits | — | — | 35,518 | — | ||||||||||||

| Tax Gross-Up | — | — | 496,535 | — | ||||||||||||

| Total | $ | — | $ | 184,229 | $ | 2,124,005 | $ | 300,004 | ||||||||

| Thomas A. Beaver | ||||||||||||||||

| Base Salary | $ | — | $ | — | $ | 549,000 | $ | — | ||||||||

| Annual Incentive Award | — | — | 304,643 | — | ||||||||||||

| Unvested and Accelerated Restricted Shares | — | 72,331 | 150,580 | 48,678 | ||||||||||||

| Unvested and Accelerated Performance Shares | — | — | 75,468 | 66,719 | ||||||||||||

| Deferred Compensation Plan | — | — | — | — | ||||||||||||

| Health & Welfare Benefits | — | — | 13,608 | — | ||||||||||||

| Tax Gross-Up | — | — | — | — | ||||||||||||

| Total | $ | — | $ | 72,331 | $ | 1,093,299 | $ | 115,397 | ||||||||

| Mark J. Tervalon | ||||||||||||||||

| Base Salary | $ | — | $ | — | $ | 559,446 | $ | — | ||||||||

| Annual Incentive Award | — | — | 264,514 | — | ||||||||||||

| Unvested and Accelerated Restricted Shares | — | 91,802 | 193,367 | 63,498 | ||||||||||||

| Unvested and Accelerated Performance Shares | — | — | 93,480 | 86,319 | ||||||||||||

| Deferred Compensation Plan | 10,541 | 10,541 | 10,541 | 10,541 | ||||||||||||

| Health & Welfare Benefits | — | — | 34,929 | — | ||||||||||||

| Tax Gross-Up | — | — | — | — | ||||||||||||

| Total | $ | 10,541 | $ | 102,343 | $ | 1,156,277 | $ | 160,358 | ||||||||

| Martin Malmvik | ||||||||||||||||

| Base Salary | $ | — | $ | 500,099 | $ | — | $ | — | ||||||||

| Annual Incentive Award | — | — | — | — | ||||||||||||

| Unvested and Accelerated Restricted Shares | — | 16,174 | 33,065 | 12,312 | ||||||||||||

| Unvested and Accelerated Performance Shares | — | — | 13,680 | 14,709 | ||||||||||||

| Deferred Compensation Plan | — | — | — | — | ||||||||||||

| Health & Welfare Benefits | — | 67,314 | 67,314 | — | ||||||||||||

| Tax Gross-Up | — | — | — | — | ||||||||||||

| Total | $ | — | $ | 583,587 | $ | 114,059 | $ | 27,021 | ||||||||

25

Directors’ Compensation

Termination Without Cause | Non-Termination Change in Control | Change in Control and NEO Resigns for Good Reason or is Terminated Without Cause | Disability | Death | ||||||||||||||||

| John C. Corey | ||||||||||||||||||||

| Base Salary | $ | 1,320,000 | $ | - | $ | 1,320,000 | $ | 165,000 | $ | - | ||||||||||

| Annual Incentive Award | 1,161,045 | - | 1,161,045 | - | - | |||||||||||||||

| Long-term Incentive Award | 478,884 | 783,628 | 783,628 | 478,884 | 478,884 | |||||||||||||||

| Unvested and Accelerated Restricted Common Shares | 3,071,692 | 5,527,132 | 5,527,132 | 1,482,155 | 1,482,155 | |||||||||||||||

| Unvested and Accelerated Performance Common Shares | 560,011 | 2,919,571 | 2,919,571 | 1,503,998 | 1,503,998 | |||||||||||||||

| Health & Welfare Benefits | 55,937 | - | 55,937 | - | - | |||||||||||||||

| Tax Gross-Up | - | - | 1,626,114 | - | - | |||||||||||||||

| Total | $ | 6,647,569 | $ | 9,230,331 | $ | 13,393,427 | $ | 3,630,037 | $ | 3,465,037 | ||||||||||

| George E. Strickler | ||||||||||||||||||||

| Base Salary | $ | 516,000 | $ | - | $ | 688,000 | $ | - | $ | - | ||||||||||

| Annual Incentive Award | - | - | 430,349 | - | - | |||||||||||||||

| Long-term Incentive Award | 138,298 | 226,306 | 226,306 | 138,298 | 138,298 | |||||||||||||||

| Unvested and Accelerated Restricted Common Shares | 912,867 | 1,683,372 | 1,683,372 | 453,831 | 453,831 | |||||||||||||||

| Unvested and Accelerated Performance Common Shares | 186,972 | 930,031 | 930,031 | 459,884 | 459,884 | |||||||||||||||

| Health & Welfare Benefits | 17,953 | - | 23,938 | - | - | |||||||||||||||

| Tax Gross-Up | - | - | 465,827 | - | - | |||||||||||||||

| Total | $ | 1,772,090 | $ | 2,839,709 | $ | 4,447,823 | $ | 1,052,013 | $ | 1,052,013 | ||||||||||

| Mark J. Tervalon | ||||||||||||||||||||

| Base Salary | $ | 300,700 | $ | - | $ | 601,400 | $ | - | $ | - | ||||||||||

| Annual Incentive Award | - | - | 320,755 | - | - | |||||||||||||||

| Long-term Incentive Award | 83,544 | 136,709 | 136,709 | 83,544 | 83,544 | |||||||||||||||

| Unvested and Accelerated Restricted Common Shares | 563,561 | 1,058,877 | 1,058,877 | 590,546 | 590,546 | |||||||||||||||

| Unvested and Accelerated Performance Common Shares | 125,259 | 603,178 | 603,178 | 289,308 | 289,308 | |||||||||||||||

| Health & Welfare Benefits | 17,094 | - | 34,189 | - | - | |||||||||||||||

| Tax Gross-Up | - | - | 280,702 | - | - | |||||||||||||||

| Total | $ | 1,090,158 | $ | 1,798,764 | $ | 3,035,810 | $ | 963,398 | $ | 963,398 | ||||||||||

| Thomas A. Beaver | ||||||||||||||||||||

| Base Salary | $ | 281,300 | $ | - | $ | 562,600 | $ | - | $ | - | ||||||||||

| Annual Incentive Award | - | - | 302,763 | - | - | |||||||||||||||

| Long-term Incentive Award | 66,447 | 108,731 | 108,731 | 66,447 | 66,447 | |||||||||||||||

| Unvested and Accelerated Restricted Common Shares | 451,673 | 854,239 | 854,239 | 481,595 | 481,595 | |||||||||||||||

| Unvested and Accelerated Performance Common Shares | 103,159 | 492,648 | 492,648 | 234,394 | 234,394 | |||||||||||||||

| Health & Welfare Benefits | 6,293 | - | 12,586 | - | - | |||||||||||||||

| Tax Gross-Up | - | - | - | - | - | |||||||||||||||

| Total | $ | 908,872 | $ | 1,455,618 | $ | 2,333,567 | $ | 782,436 | $ | 782,436 | ||||||||||

| Michael D. Sloan | ||||||||||||||||||||